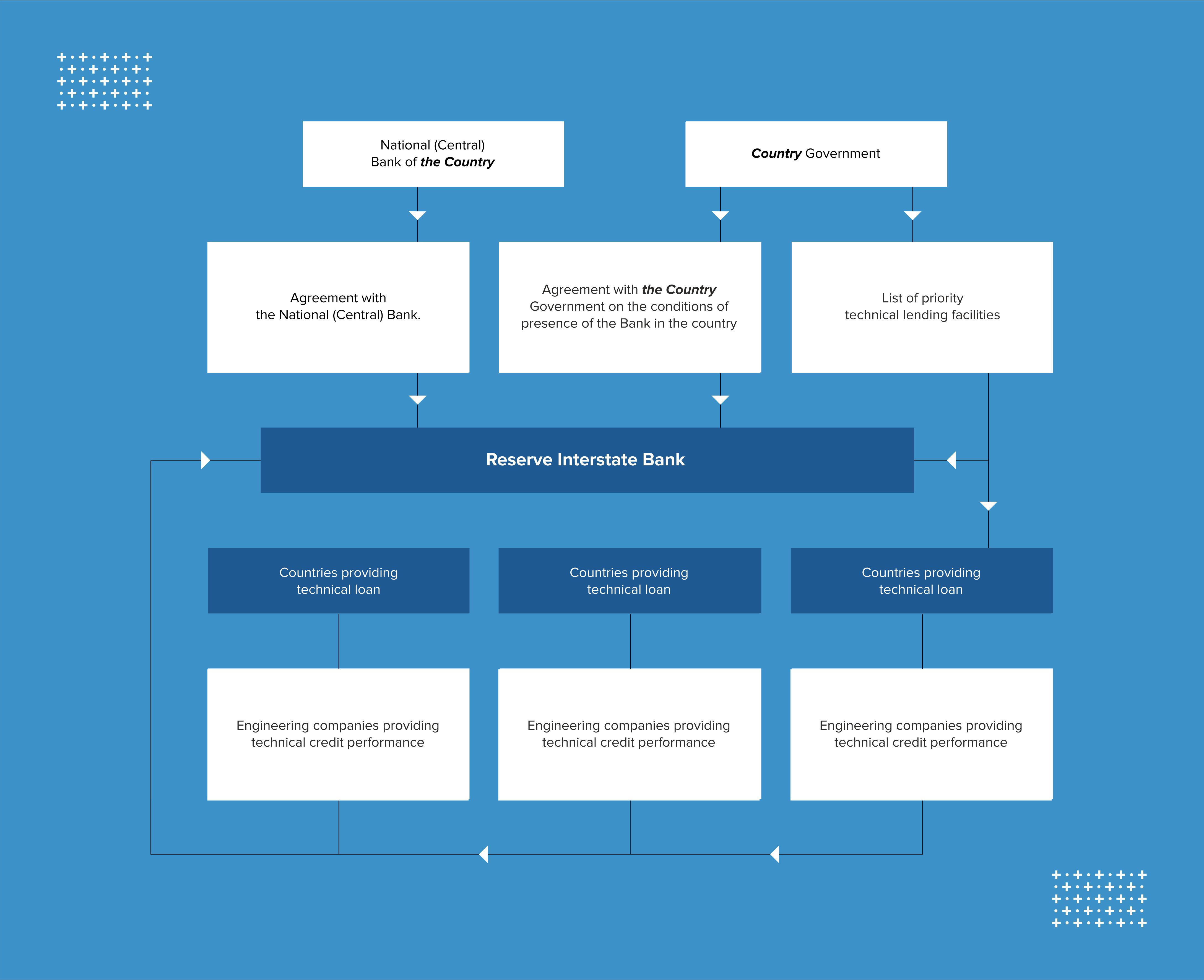

1. Agreements are signed between the “RIB” and the National (Central) Bank of the Country, the “RIB” and the Country Government on the conditions for the presence of the Reserve Interstate Bank in the Country.

2. Agreements are signed between the “RIB” and the Country Government on the list of newly established enterprises for which technical lending is necessary.

3. Agreements are signed with engineering firms of states that can carry out technical lending and construction of enterprises in accordance with the list provided by the Country Government – on the territory of the Country.

4. After a fully signed agreement package for the start of construction, the facility is implemented through ICO (initial coin offering). The collected resources are a guarantee for repaying a technical loan and can be used as working capital through a commercial bank – defined by the National (Central) Bank of the Country as agreed by the parties involved in the project.

5. Upon completion of construction and start-up of the enterprise, the ready-made company is being sold at IPO. At this, the joint work of the “RIB” with the Country Government and other participants on a particular object ends and continues on other objects.