The subsystem is to be used for the bank loan portfolio accounting and also to monitor current contracts, receive reports, organize automatized working places for employees involved in supporting bank settlements with customers in the field of credit and financial activities. It allows you to automate the work with contracts of legal entities and individuals with retail sales up to 100 000–200 000 current contracts.

Program unit purpose:

- Arrangement and maintenance of term credits and credit lines;

- Bank credit portfolio maintenance and analysis;

- Accounting and taxation management of credit transactions;

- Maintenance of transactions under a single contract of group of contracts.

Credit contracts types:

- Simple term credits;

- Credit lines with disbursement and indebtedness limit;

- Overdraft contracts;

- Call loans.

Advanced features:

- Simple term credits;

- Credit lines with disbursement and indebtedness limit;

- Overdraft contracts;

- Call loans.

Functionality:

- Automated maintenance of credit contracts;

- Calculation, accrual and accounting of interest, penalties and fees;

- Use of the base rate (refinancing of the National (Central) Bank, Mibor, Libor, etc.);

- Generation, improvement and accounting of reserves;

- Past-due indebtedness tracking and accounting;

- Status check at the user-specified date;

- Transaction maintenance for both past and future dates;

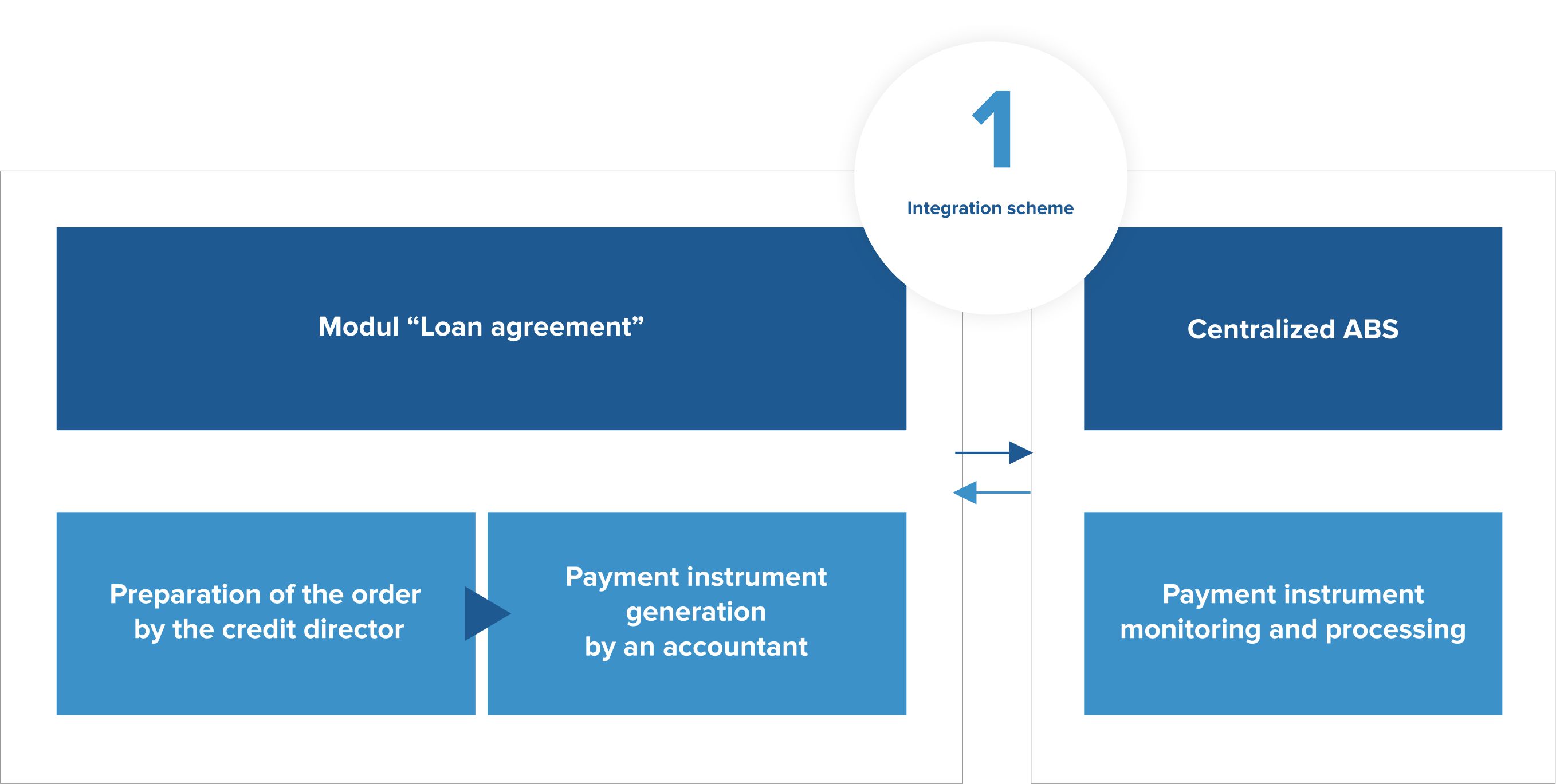

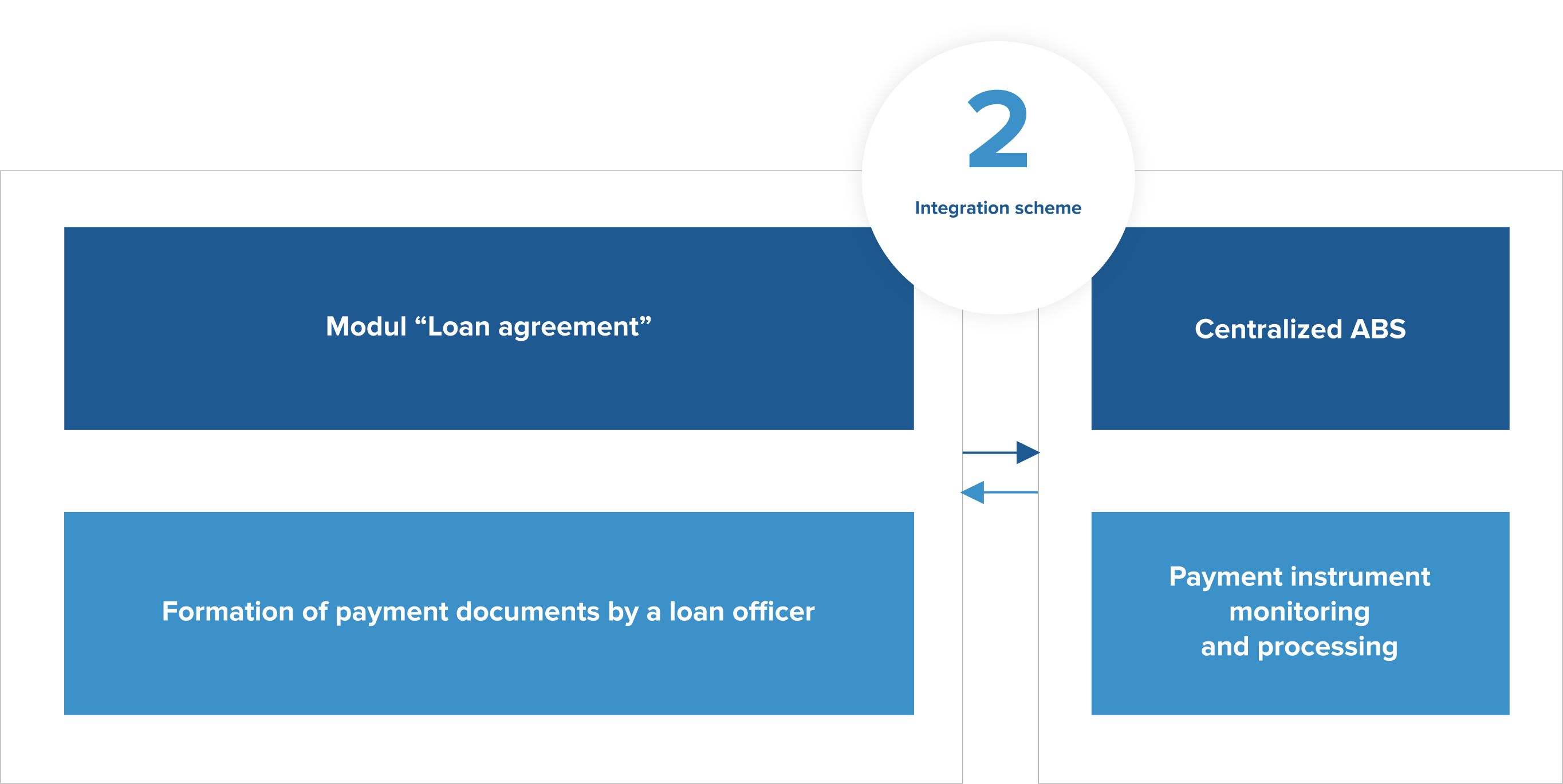

- Generation of payment instruments related to the transaction;

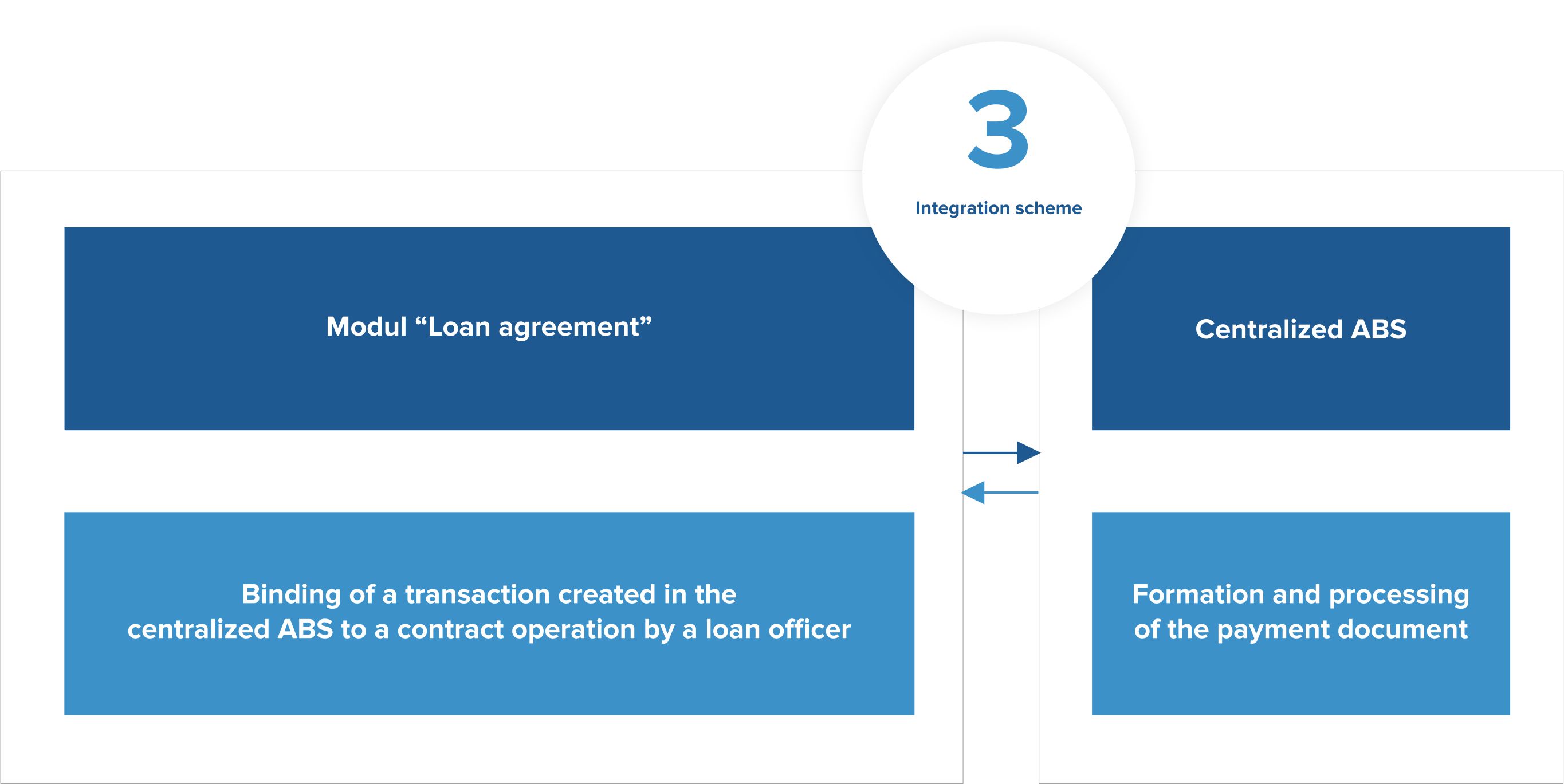

- Tracking and linking the documents generated in the Centralized ABS to transactions;

- Execution and maintenance of security agreements;

- Overdraft contracts maintenance;

- Generation and printing of contract texts by a template;

- Transactions recovery and declarative actions performance.

Sustained reporting:

Sustained reporting:

- Standard reporting of the National (Central) Bank;

- A set of internal analytical reports;

- Option to self-report;

- Reports implementation on the bank’s request;

- Reports uploading in different formats (Excel, Word, Dbf, etc.)

Accounting (depends on the country):

By using our subsystem, you will be able:

- To generate accounting documents for the purposes of record keeping on accounts in the framework of the Operation Bank Day complex;

- To identify (compare) postings of “internal” accounts with postings generated in the framework of the Operation Bank Day complex;

- If necessary, to change the accounting model, on the basis of which the subsystem generates accounting documents, independently.

MS OFFICE integration:

- Automatic completion of individual contracts using MS WORD;

- Printing a wide range of reports using MS WORD, MS EXCEL;

- Custom reports configuring.

The information system allows you to transfer, process and summarize all the primary data quickly.

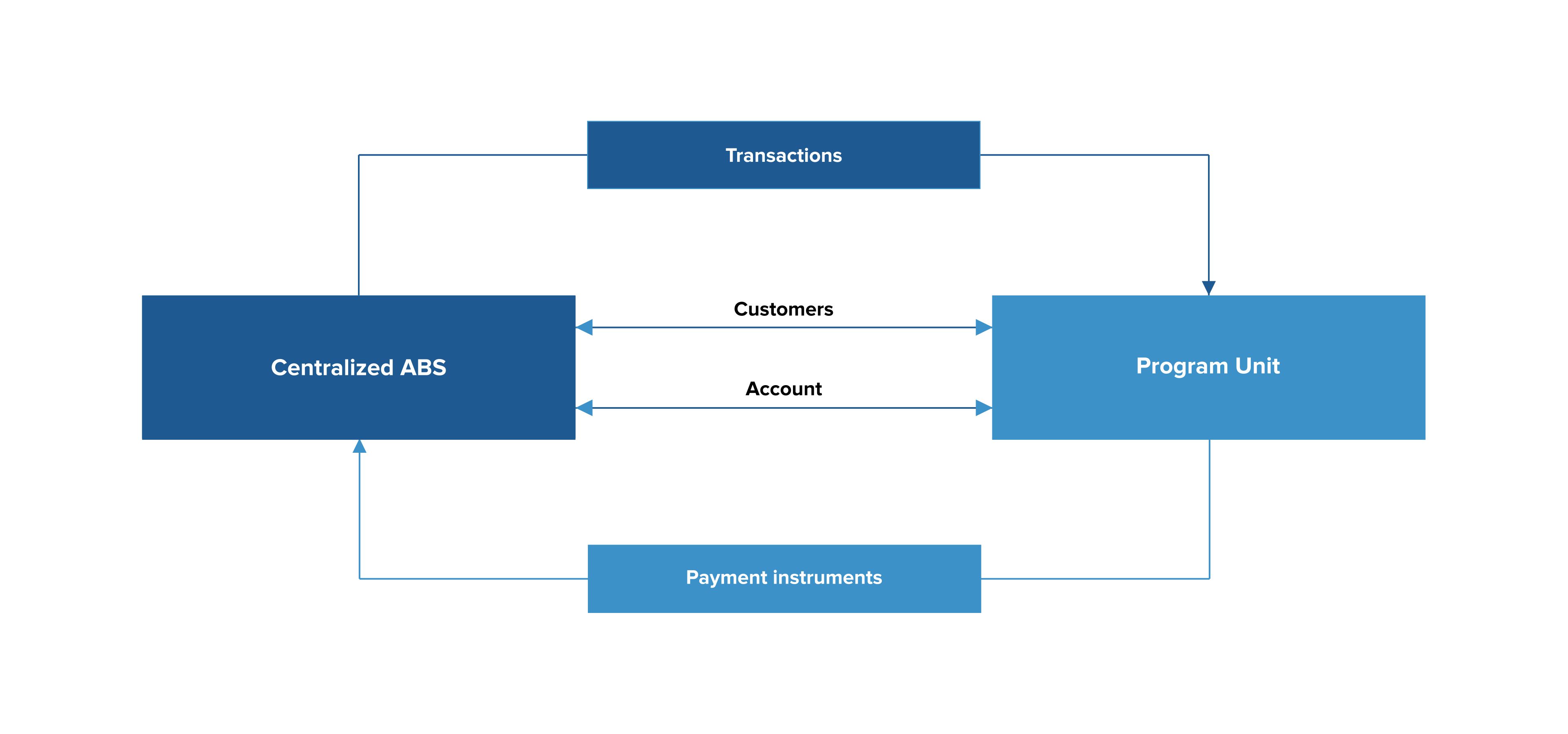

Interface with other program units:

- Receiving information on incoming payment instruments from the Accounting program unit (depends on the country).

Credits use standard functionality of Accounting program unit (depends on the country):

- Generation of outgoing, internal, cash payment instruments (for further processing in the Accounting program unit);

- Automatic opening and closing of “external” personal accounts;

- Adding information to external directories (Client Catalogue, Personal Account Catalogue).

Audit and security:

- Users’ actions fixation (audit);

- Correction of errors made by the operator through a system of recovery;

- A flexible system for organizing user access rights to the functionality of the subsystem.

The information system provides a clear regulation of operator rights and his actions monitoring.

Access rights.

The system of organization of user rights is multilevel:

- Level 1 : Access to information;

- Level 2 : Access to menu items;

- Level 3 : Access to configuration functionality.

Main advantages:

- Option to record the full cycle of actions on credits;

- Automatic generation of accounting documents;

- Optic to receive full packages of documents and reports;

- Easy navigation and user-friendly interface.