An objective of the presented product is automation of business units which work with letters of credit.

Considering competition in the market of classic banking business (Cash Settlement Services, Loans, Deposits) and reduction of profit from transactions in the Money Market and Forex, banks have had to develop new services to attract customers. A potential customer will choose a Bank not only subject to fee amounts and interest rates but also subject to a range of services it provides. Our company policy with the objective to increase the number and types of automated banking transactions involves continuous expansion of our ABS functional.

Increase in import and export business has caused banks to develop a new service, namely a commercial contract management, in particular execution and support of letters of credit for payments. In response to banks’ need for such activity to be automated, and in line with its policy followed by our employees, the “Letters of Credit” program unit has been developed.

It should be noted that automation of such operations is low now. Many banks, even major banks, maintain accounting in Excel or apply their own solutions.

Program Unit Purpose.

- Letter of Credit issuance and maintenance pursuant to regulatory documents;

- Generating, downloading and processing of SWIFT (Society for Worldwide Interbank Financial Telecommunications) / TELEX class 7 messages;

- Payment document preparation and linking;

- Reflection of accounting transactions.

Functionality.

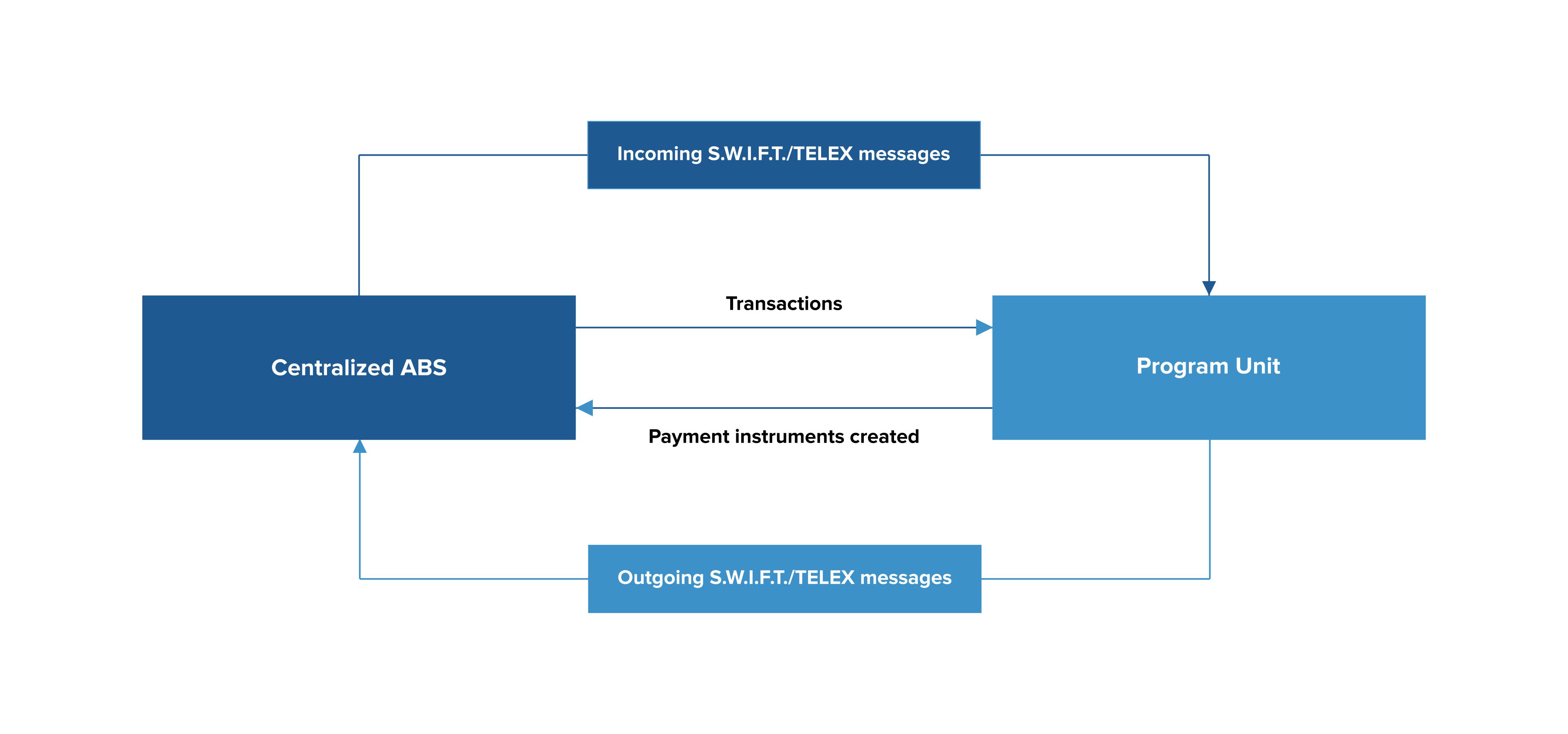

It should be noted that the program unit is fully integrated with the “Centralized ABS” program unit at the level of payment instruments and SWIFT messages:

- Registration of export and import letters of credit;

- Drafting of letters of credit registered;

- Generation of on- and off-balance sheet payment instruments;

- Linking of transactions created in other subsystems to letters of credit;

- Fee calculation and creation;

- SWIFT / TELEX message generation;

- Reminder of a letter of credit events;

- Downloading, processing and binding of incoming messages in a SWIFT format;

- Provisions creation and accounting.

The program unit creates payment instruments and outdoing messages which are further processed in the core in a standard manner based on a payment instruments type, while all restrictions imposed on an instruments type and accounts specified therein (processing technique, negative balance check, status, etc.) are under control.

The program unit creates payment instruments and outdoing messages which are further processed in the core in a standard manner based on a payment instruments type, while all restrictions imposed on an instruments type and accounts specified therein (processing technique, negative balance check, status, etc.) are under control.

Procedure.

- Letter of Credit preparation;

- Modification of terms;

- Payment arrangement;

- Letter of Credit withdrawal;

- SWIFT / TELEX message creation;

- Accounting transaction creation.

Customized presets of transaction accounting (Depends on the country).

Letter of Credit type is defined:

- Revocable / Irrevocable;

- Secured / Unsecured;

- Export / Import, etc.

Payment instrument type is defined:

- Internal Payment Order;

- Interbank Payment Order;

- Memorial slip, etc.

Definition of a type of an account debited.

Definition of a type of an account credited.

Types of accounts in a transaction are defined:

- Customer account to write off covers and fees;

- Off-balance sheet accounts, provisions and liabilities accounts, income and expenditure accounts.

A transaction amount is determined:

- Letter of credit amount;

- Fee;

- Provision accrual, write-off and correction;

- Changes in a letter of credit amount.