Every State in the world strives to attract resources for improvement of the welfare of its residents, balanced growth of science, manufacture, agriculture and other fields and life spheres of the state.

There are different ventures and methods for investment project implementation in the world. The Interstate Bank is one of the ventures that opens up fresh opportunities for making guarantees to attract financial resources. The Reserve Interstate Bank is capable of financial resources attraction at the new level, and among other things, the Bank is posed to credit the Government, National (Central) Bank, commercial banks, joint ventures, infrastructure projects. Already this year the borrowings, internal or external, can be used if this project is implemented properly.

Government programs for enterprise establishment that tend to be valuable for tax collection in order to create state budget of all levels are taken as a basis. Upon the signing of the attached agreements first-priority objects offered for technical credit provision are to be proceeded.

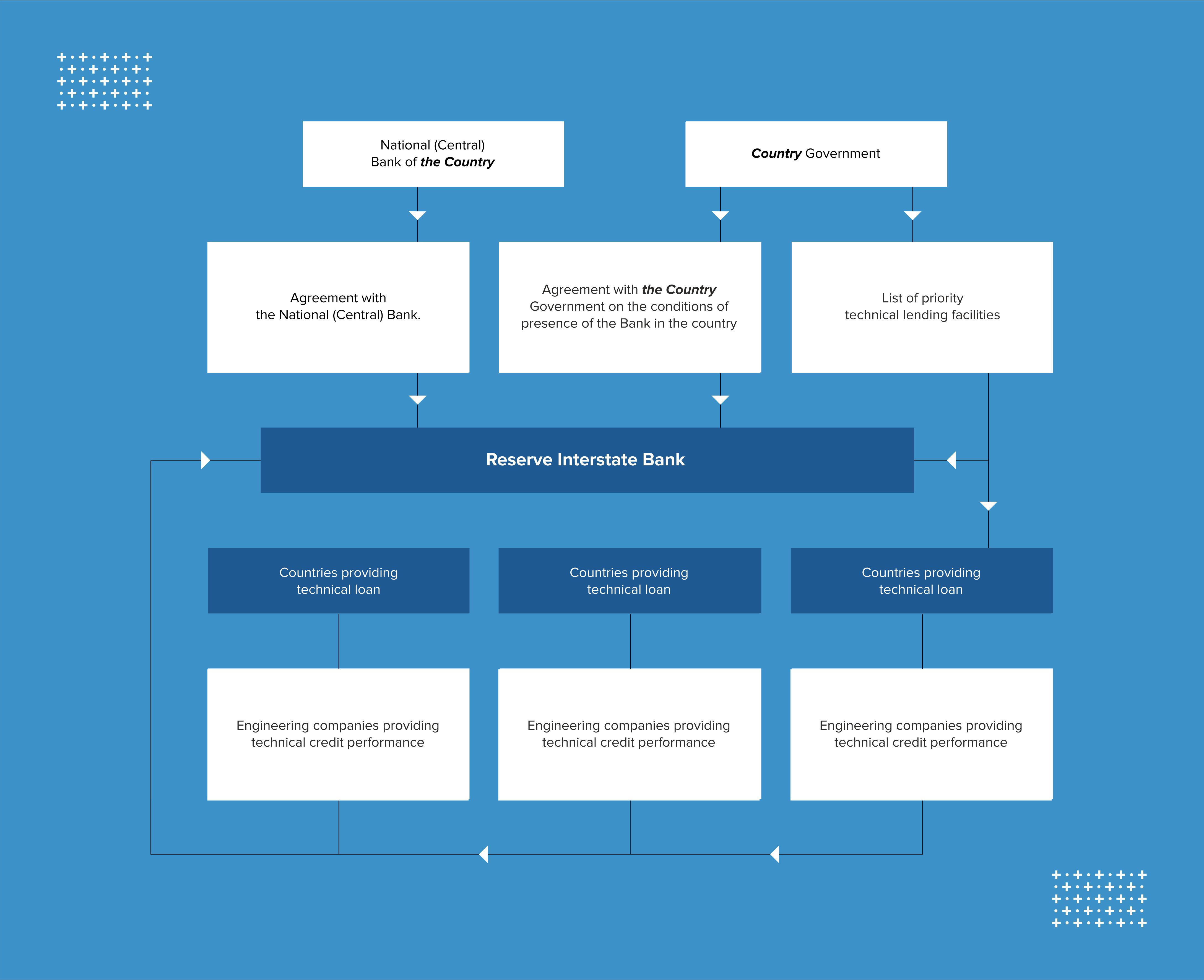

Having identified the most advanced states that have the opportunities to establish the necessary enterprise, the Reserve Interstate Bank “RIB” coordinates the structure of the transaction between the customer – the County Government and the Government providing technical credit.

Upon approval of the future owners of the new object with the customer government the Reserve Interstate Bank implements the object at the stage of construction attracting funds available at the world market and using new technologies of internet resource assimilation on completing the object construction.

The only thing required from the country’s leadership is the political guarantee and government participation in case of personal interest in the project if the object has a strategic impact for the state.

The common scheme of interaction and the transaction structure are as follows:

The first. The Bank organizes and coordinates bilateral and provides multilateral interstate payments between central (national) banks on trade or any other transactions and their regular completion based on multilateral clearing (offset of liabilities).

The second. The Reserve Interstate Bank uses applied banking system “Inversion XXI Century”, hereinafter referred to as the ABS (Automated Banking System). Such ABS is customized by the National (Central) Bank of each country for legislative infrastructures of every particular country and for statutory instruments through particular parameters. Therefore the ABS is unique for each country and not similar to any ABS of any other country. This relates to all banking business elements, namely the chart of accounts for bookkeeping, accounting transactions and documents, financial statements to the National (Central) Bank, correspondent banking, payment documents, and a national document flow structure. However, the set of banking transactions is standardized worldwide. Therefore we present standard banking transactions in the ABS Section. It should be noted that you can only become a client of our Bank after signing two Agreements, an Agreement with the country’s Government and an Agreement with the country’s National (Central) Bank.

The third. The Reserve Interstate Bank uses international banking card processing which includes services to corporations and individuals or merchants, as well as an access to client accounts by using ATMs, trade desks and cell phones. The processing is connected online to the bank’s back office.

The forth. It is an implementation of members’ Agreements through Smart Contracts in a blockchain environment, which allows for members having a continuous online access to the document history. At the same time such access is unique and secured and has a two factor authentication. Documents are impossible to be modified without any trace.

The fifth. It is a possibility to maintain and administer accounts in crypto currencies, which provides customers with the growing advantages of the contemporary market. Finally,

The sixth. It is an enabling of all above applications on the cloud certified by PCI DSS Cloud Computing Guidelines and by other latest international standards subject to a national legislation. For example, servers with personal data in Russia and European countries must be located within the country, etc.