Purpose of the Complex.

Software and hardware complex “Cash Handling Center” (SHC CHC) is designed to automate technical processes for a bank’s services and cash transactions:

- Money collection, recounting and crediting to customer accounts;

- Money collection and sending to a third party for recounting;

- Cash delivery to the Bank’s customers;

- Exchange creation and delivery as may be ordered by a customer;

- Replenishment of a credit institution’s subsidiaries with cash;

- Collection, acceptance and recounting of pouches with Valuables received from a credit institution’s subsidiaries;

- Technical equipment maintenance (Cash-in, ATM, TCD);

- Sending of doubtful banknotes to the National (Central) Bank to have them examined by experts;

- Foreign cash purchase and sale carried out between banks under a Banknote Transaction Agreement.

Complex’s Data Structure.

SHC CHC (software and hardware complex “Cash Handling Center”) allows for maintaining directories of customers, their collection depots with addresses and time of visits, contractual and client side adapted to set up postings by transaction types and by service rating. Directories of Employees, their functional duties, teams, routes, vehicles, etc. are maintained.

Logistics Sections of SHC CHC (software and hardware complex “Cash Handling Center”):

- Client side directories;

- Personnel directories;

- Route logistics directories.

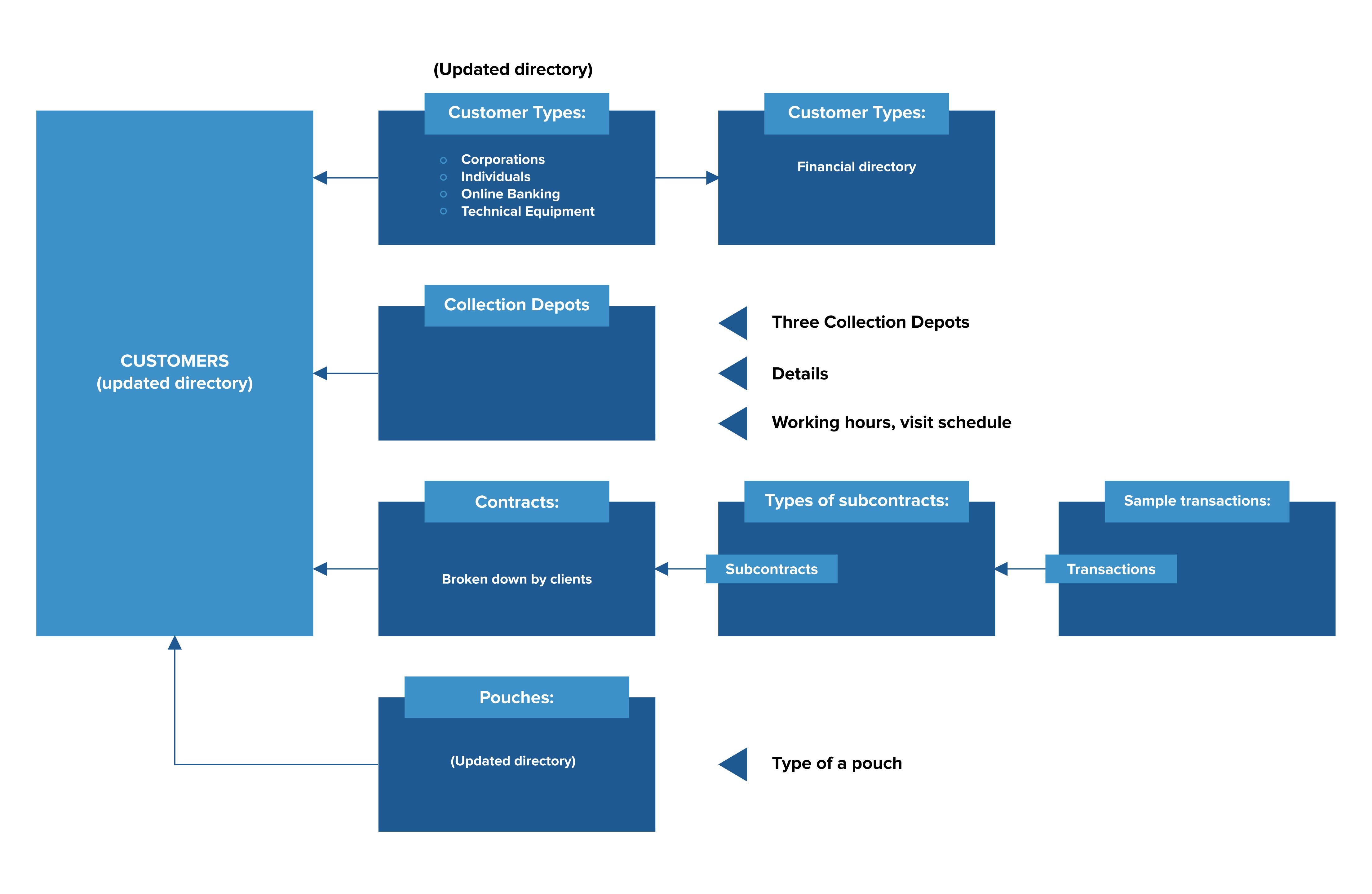

Client Side Directories.

Types of Customers – types of customers in the system are defined (Corporations, Individuals, TCD, Cash-in).

Transaction Types – a fixed list of possible customer transactions in a “Cash handling center”.

Customers – used for insertion of details in a customer data sheet.

Collection Depots – a list of collection depots broken down by customers.

Pouches – allows for pouch registration.

Contracts– used for a customer contract database.

Types of Subcontracts– a type of the service provided under a contract.

Sample transactions – transaction groups are set up by types of subcontracts.

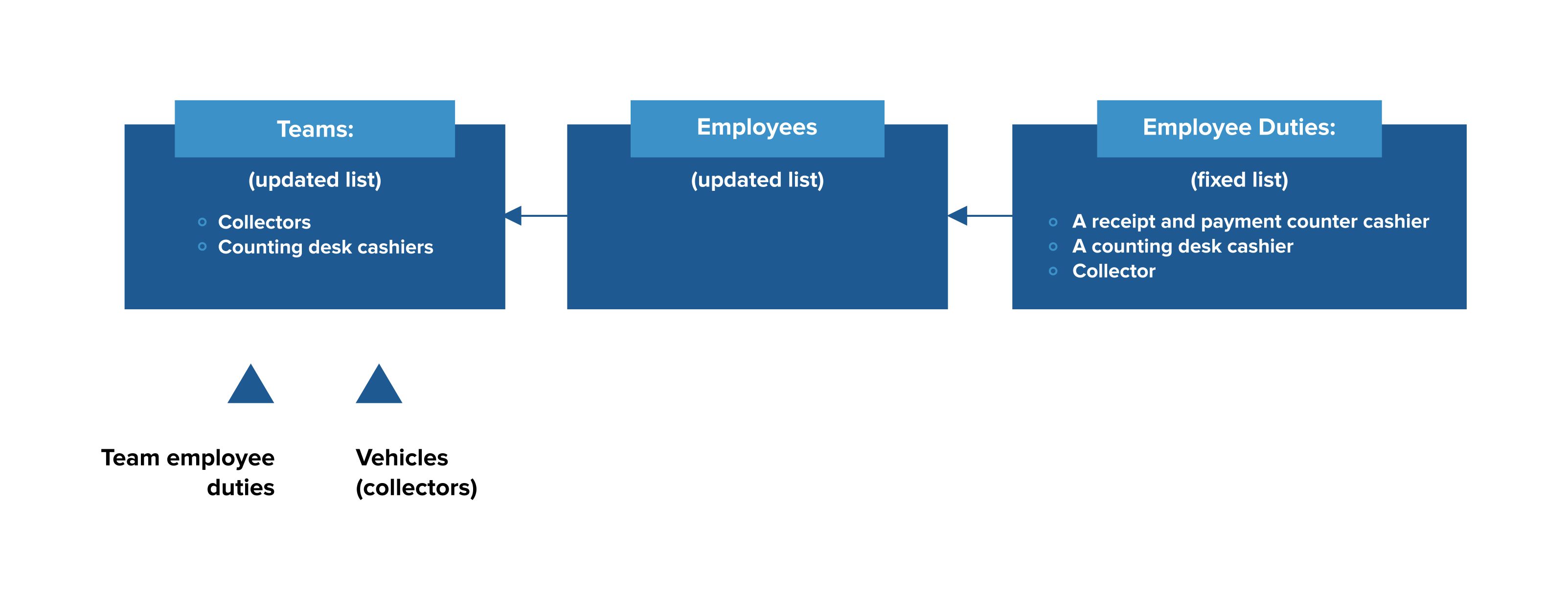

Personnel Directories:

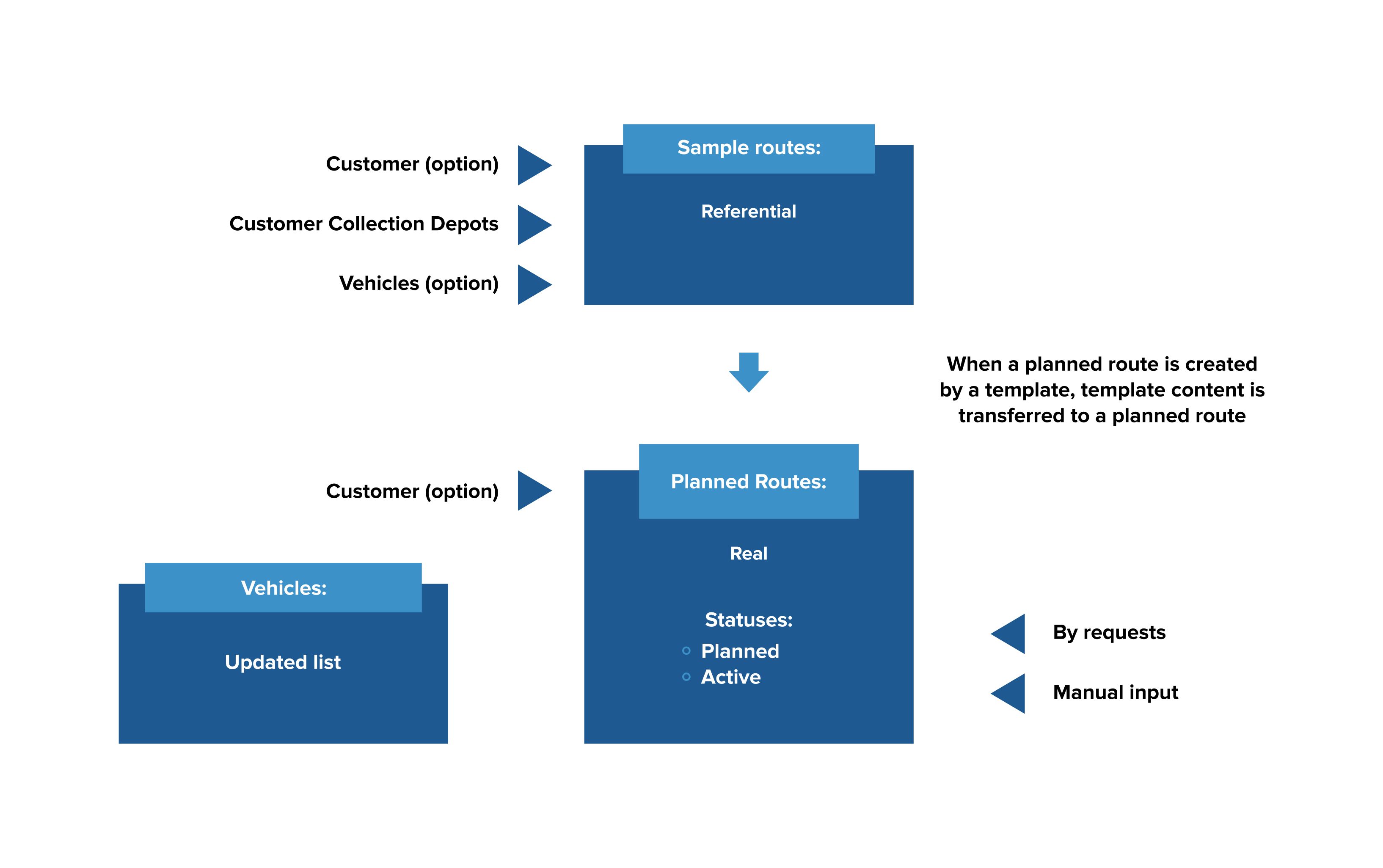

Sample Routes (reference routes) – standard collection depots to be visited on route by a vehicle used in route planning.

Sample Routes (reference routes) – standard collection depots to be visited on route by a vehicle used in route planning.

Vehicles – registration of vehicles in the possession of a collection service.

Route Logistics Directories:

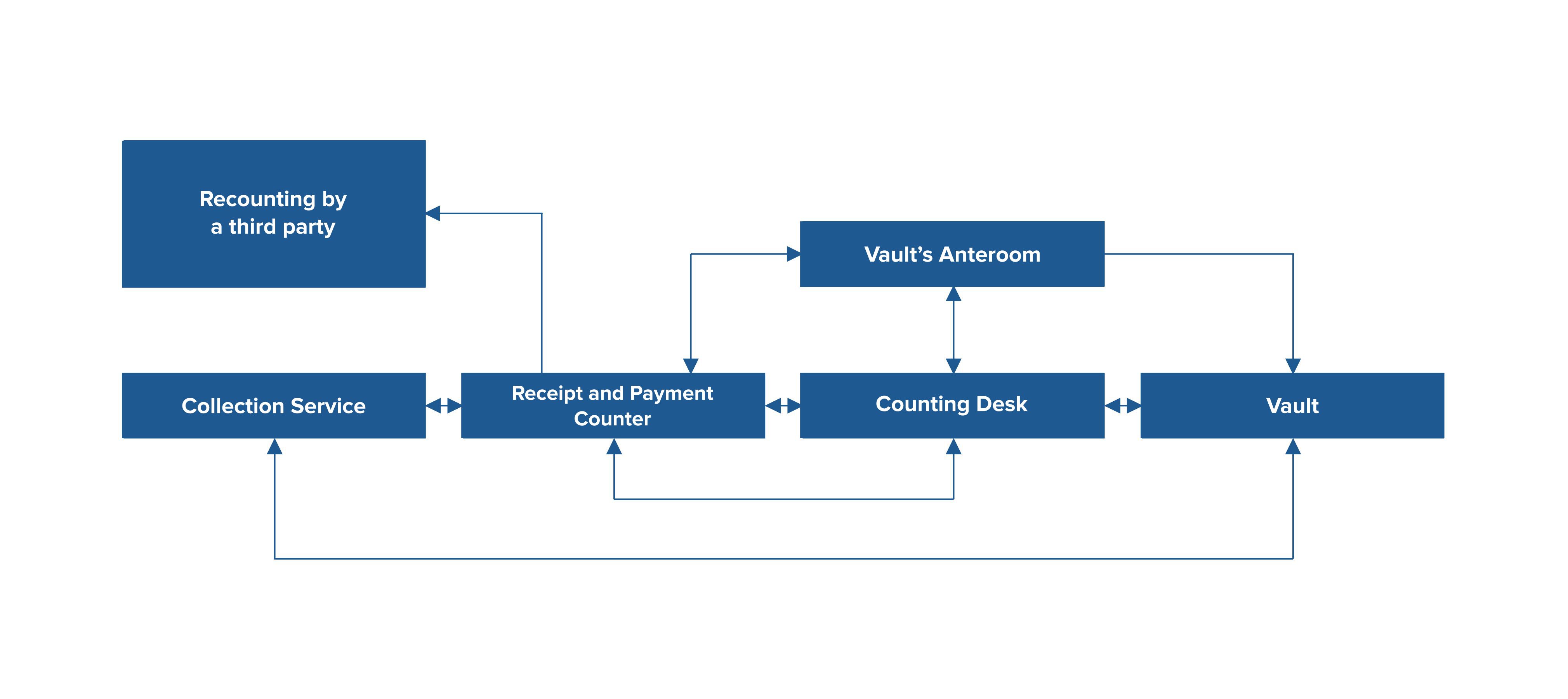

Technological chain of pouch processing:

Complex’s Functional Structure.

Complex’s Functional Structure.

The complex includes the following functional-technological blocks:

- Request execution;

- Collection;

- Receipt and Payment Counter (RPC);

- Recounting Office (RO);

- Vault.

Request Execution Block.

The Request Execution block is used to coordinate the work of the CHC (Cash Handling Center) with local cash desk services by virtue of requests for transactions with cash and valuables. A call center is possible to be used for registration of requests received from customers.

Request Registration.

Automatic possibilities of the SHC CHC (software and hardware complex “Cash Handling Center”) in processing requests previously typed:

- COLLECTION: Adding collection depots to a planned route by request;

- RECOUNTING OFFICE: Forming a pouch with valuables ordered in a request for a route.

RPC: A pouch acceptance at the RPC by request.

Receipt and Payment Counter Block

Automation of the Receipt and Payment Counter operations:

- Acceptance and dispatch of collection routes;

- Pouch acceptance from collectors;

- Handing out of empty and filled pouches to collectors to be dispatched for a route;

- Manual registration of pouches or registration by means of a barcode printed in an endorsement (in this case, information on a pouch number, collection depot, declared value, valuables and banknotes description is sent to the system);

- Automatic generation of accounting documents;

- Generation of requisite reports (Log Books of pouches accepted, Cash Service Reports, etc.).

Workplace of a Receipt and Payment Counter Cashier.

- At the workplace of a RPC Cashier, routes are accepted and dispatched;

- There is a possibility of integration with a two-dimensional barcode identification system BiPrint. For such purpose, a barcode should be printed in an endorsement or on a label to a pouch;

- At the time of scanning, information on a pouch number, a collection depot from which a pouch is received, declared value, valuables and banknotes description is sent to the SHC (Software and Hardware Complex).

Recounting Office Block Automation of the Recounting Office operations:

1. Cashier.

2. Supervisor.

- Cashier balancing of a Recounting Office and appointment of a team;

- Recounting of pouches with valuables that are delivered from a route;

- Recounting and packing of cash and valuables into pouches to be dispatched for a route;

- Ensures a technical process to combine balances in cash drawers;

- Handing out of cash between cashiers and shifts that work simultaneously;

- Ensures acceptance and processing of information on cash recounting from coin and cash counters;

- Automatic generation of accounting documents for crediting accounts with cash: actual amounts, doubtful surpluses and shortages, fee write-off, etc.;

- Generation of requisite reports (Reports on doubtful surpluses and shortages, Statements of pouches filled with cash and empty pouches accepted, etc.).

Vault Block.

Automation of the Vault operations:

1. Cash Manager.

- Cashier balancing of the Vault;

- Accounting of cash and off-balance sheet valuables in the bank’s vault;

- Accounting of promissory notes, accountable forms and traveler’s checks;

- Acceptance/handing over of valuables for safe custody;

- Automatic generation of accounting documents;

- Generation of requisite reports (Vault Balance Report; Vault Turnover Balance Report, etc.).