Subsystem directories:

- Securities;

- Note holders.

1. Trustees of note holders;

2. Powers of Attorney.

- Template forms;

- Internal personal accounts;

- Series of securities;

- Internally generated rates;

- Timing and rates;

- Bank officials.

Types of securities:

- Non-interest bearing notes;

- Interest bearing notes;

- Interest and non-interest bearing notes;

- “Zero yield” notes;

- “Settlement” notes;

- Certificates of deposit;

- Savings certificates.

Payments periods:

- Day certain;

- At maturity from execution;

- At sight;

- At sight (on or after the date);

- At sight (on or before the date);

- At maturity from sight.

Operations with securities:

- Option to apply filters in the general catalogue of notes (certificates);

- Necessary note (certificate) Quick Search;

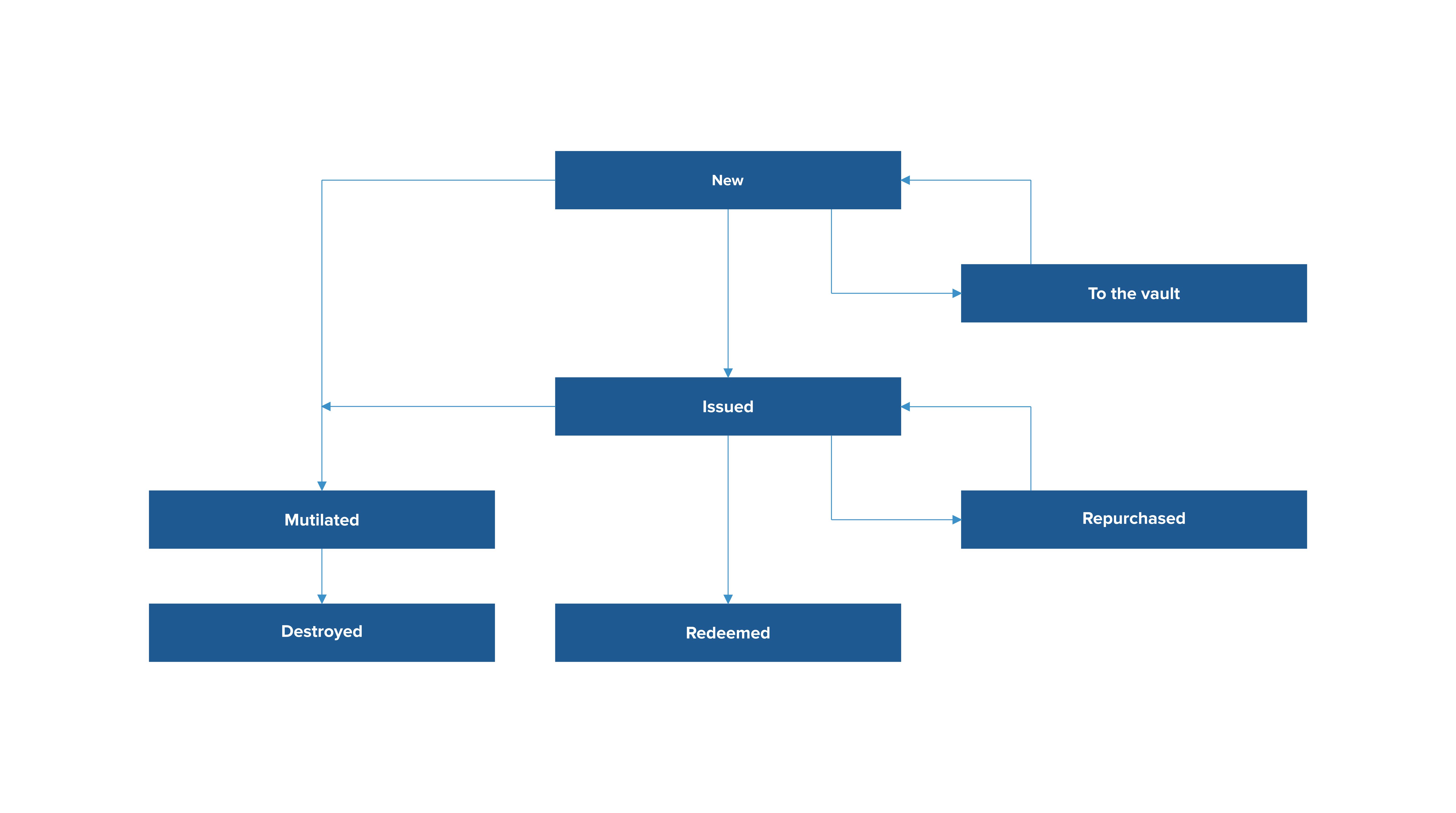

- Option to determine the status of Security and make necessary actions to fix actual change of its status;

- “Actions Register” and “Cash Flows Register” for each Security;

- Control of events of interest occurrence;

- Option to save an image of National (Central) Bank.

The implemented interest calculation mechanism allows you to:

- Use differentiated interest rates;

- Set interest terms in a flexible manner;

- Register changes in interest rates over time;

- Calculate the amount of early repayment of the note;

- Receive analytical reports on accrued interest (discounts) in MS WORD, MS EXCEL.

Notes holders directory:

- The directory stores all information about the client (personal data, addresses, details, etc);

- The directory is a subset of the Customers directory of the Accounting program unit;

- “Trustees of Note Holders” directory;

- “Powers of Attorney” directory.

Work with template forms:

- Analytical accounting of template forms is maintained with a break down into: Series, Number, Template form type, Beholden official;

- For each template form you can examine “Actions Register” and “Cash Flows Register”;

- Automatic generation of accounting documents. Receipt of intrabank documents provided for actions with template forms.

Bank activities technology cycle scheme:

Accounting (Depends on the country).

Using our subsystem, you shall get the opportunity:

- To generate accounting documents for the purposes of record-keeping on accounts within the framework of “Operation Bank Day” complex;

- To identify (compare) postings of “internal” accounts with the postings generated within the framework of “Operation Bank Day” complex;

- If necessary, to independently change the accounting model, on the basis of which the subsystem generates accounting documents.

Operations with accounts:

- There is a catalogue of “internal” personal accounts in the system, where analytical accounting of notes is performed;

- “Accounts in the Main Book” correspond to “internal” accounts. Postings are generated according to these accounts;

- “Internal” personal accounts are opened by the subsystem automatically. Availability of automatic account opening in the Main Book is defined by the settings;

- Generation algorithm of an internal personal account is defined by the account mask settings;

- The opportunities to view (print) the book of internal personal messages and to output reports are realized.

MS OFFICE integration:

- Automatic generation of individual contracts for sale, payment of notes etc. using MS WORD;

- Printing a wide range of reports using MS WORD, MS EXCEL;

- Custom reports configuring.

The information system allows you to transfer, process and summarize all primary data quickly.

Interface with other program units:

- Receiving information on incoming payment instruments from the “Accounting program unit” (depends on the country).

The “Own Notes” program unit uses standard functions of the “Accounting” program unit, “ABS” (Automated Banking System).

- Generation of outgoing, internal, cash payment instruments (for further processing in the Accounting program unit);

- Operations for automatic opening and closing of “external” individual accounts;

- Adding information to external directories (“Client Catalogue”, “Personal Account Catalogue”).

Audit and security:

- Users’ actions fixation (audit);

- Correction of errors made by the operator through the recovery system;

- A flexible system for organizing user access rights to the subsystem functionality.

The information system provides for a clear regulation of operator’s rights and for monitoring of his actions.

Main advantages:

- Option to record the full cycle of actions on securities;

- Automatic generation of accounting documents;

- Option to obtain full packages of documents and reports;

- Convenient navigational features and a user-friendly interface.