Program Unit Purpose:

- Execution and maintenance of fixed deposits and demand agreements;

- The bank’s deposit portfolio maintenance and analysis;

- Transactions both under a separate contract and under a group of contracts;

- Deposit operation bookkeeping and tax accounting (depends on the country).

Deposit Agreement Types:

- Fixed deposits;

- Demand deposits.

Potential of Interest Calculation Mechanism:

- Applying of tiered interest rates that depend on deposit amounts and periods;

- Monitoring of changes in interest rates over time;

- Flexible setting up of terms to accrue and pay interest;

- Accrued interest calculation as of any date;

- Interest calculation as of any date.

Functionality:

- Maintaining of a catalogue of contracts that provide for conditions for interest accrual and payment;

- Interest calculation, accrual and accounting by a group of contracts;

- Tax calculation and transfer;

- Applying of a base refinancing rate of the National (Central) Bank;

- Status monitoring as of a specific date;

- Transaction execution for the last and future date;

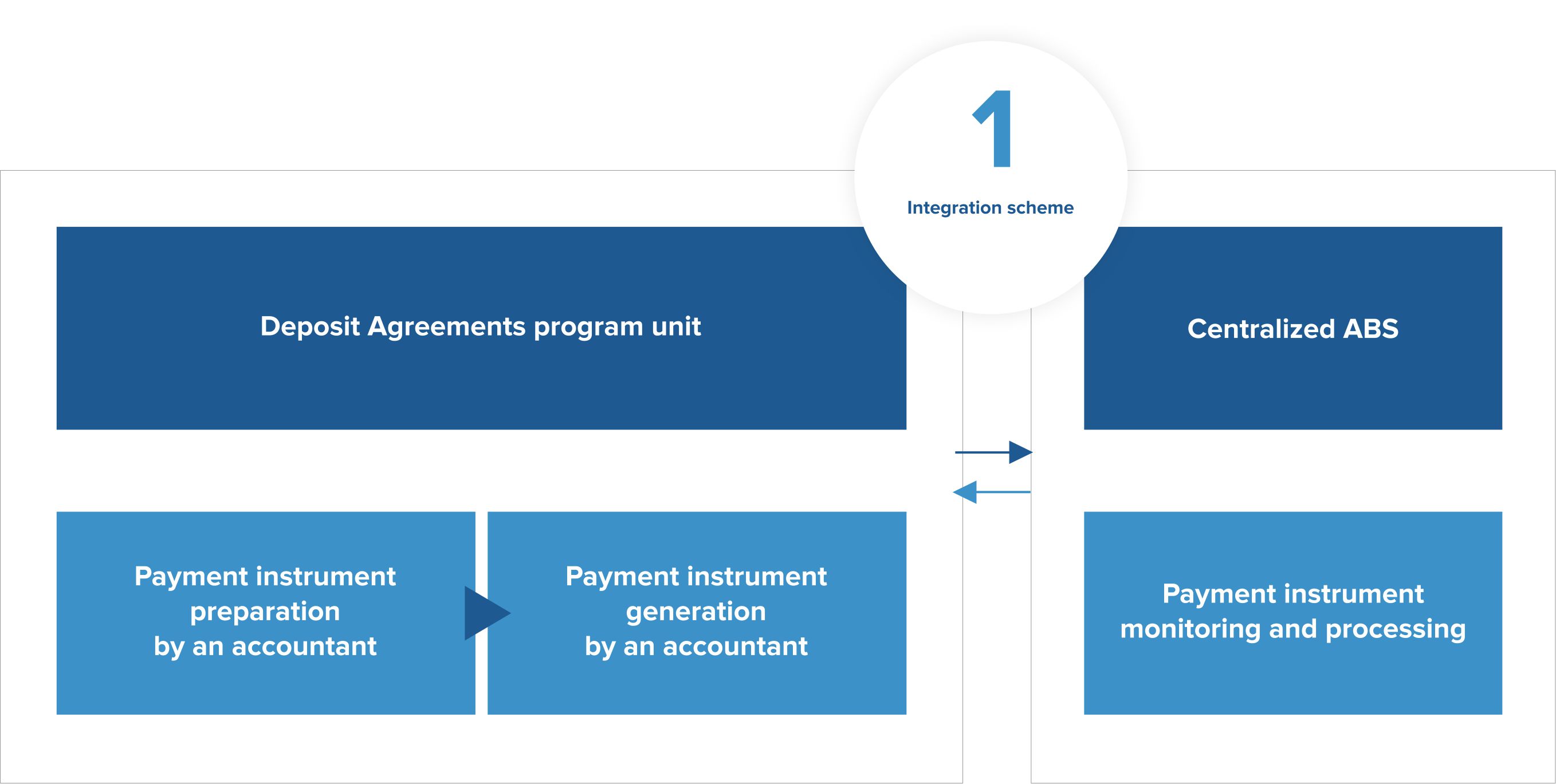

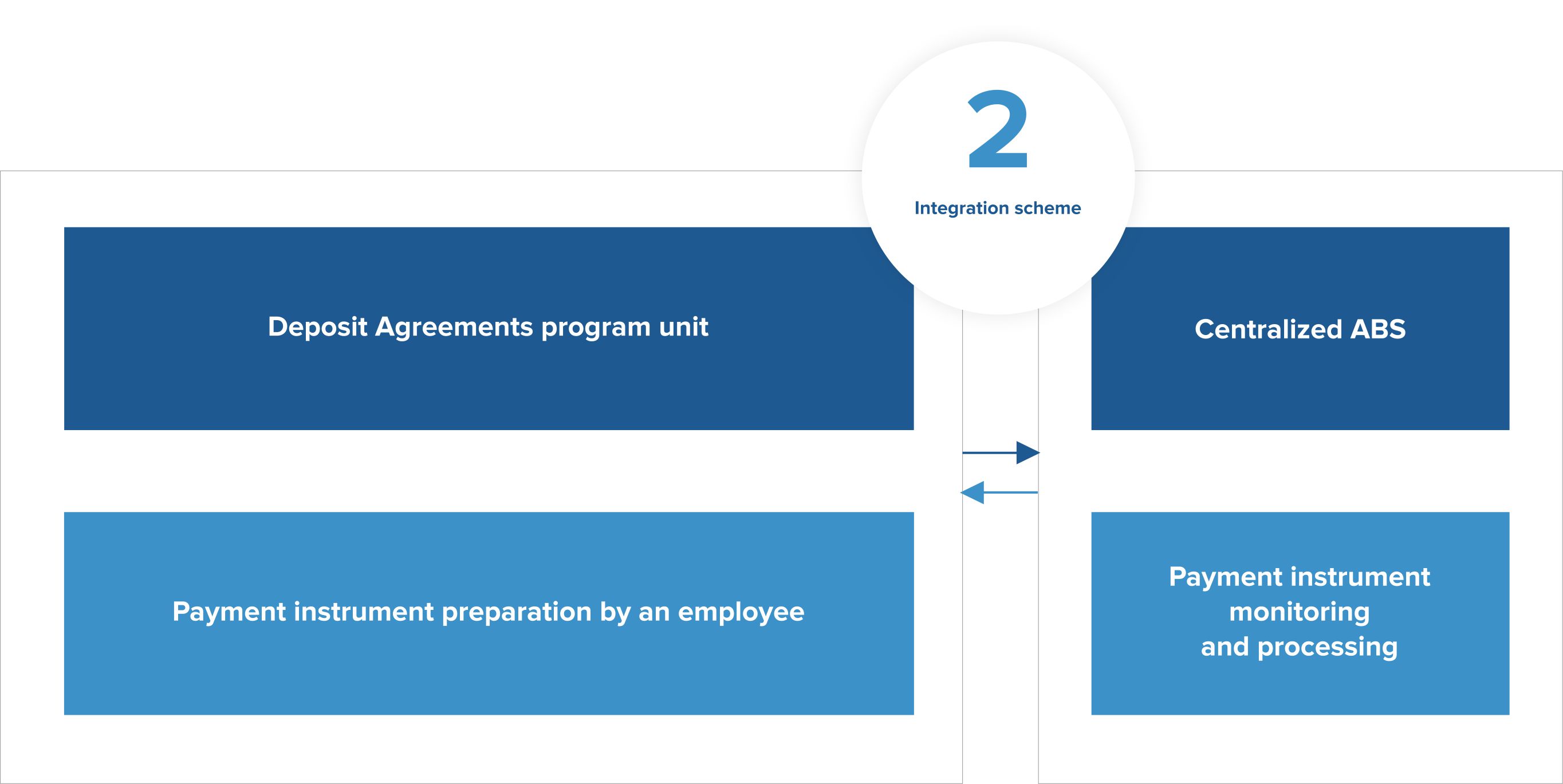

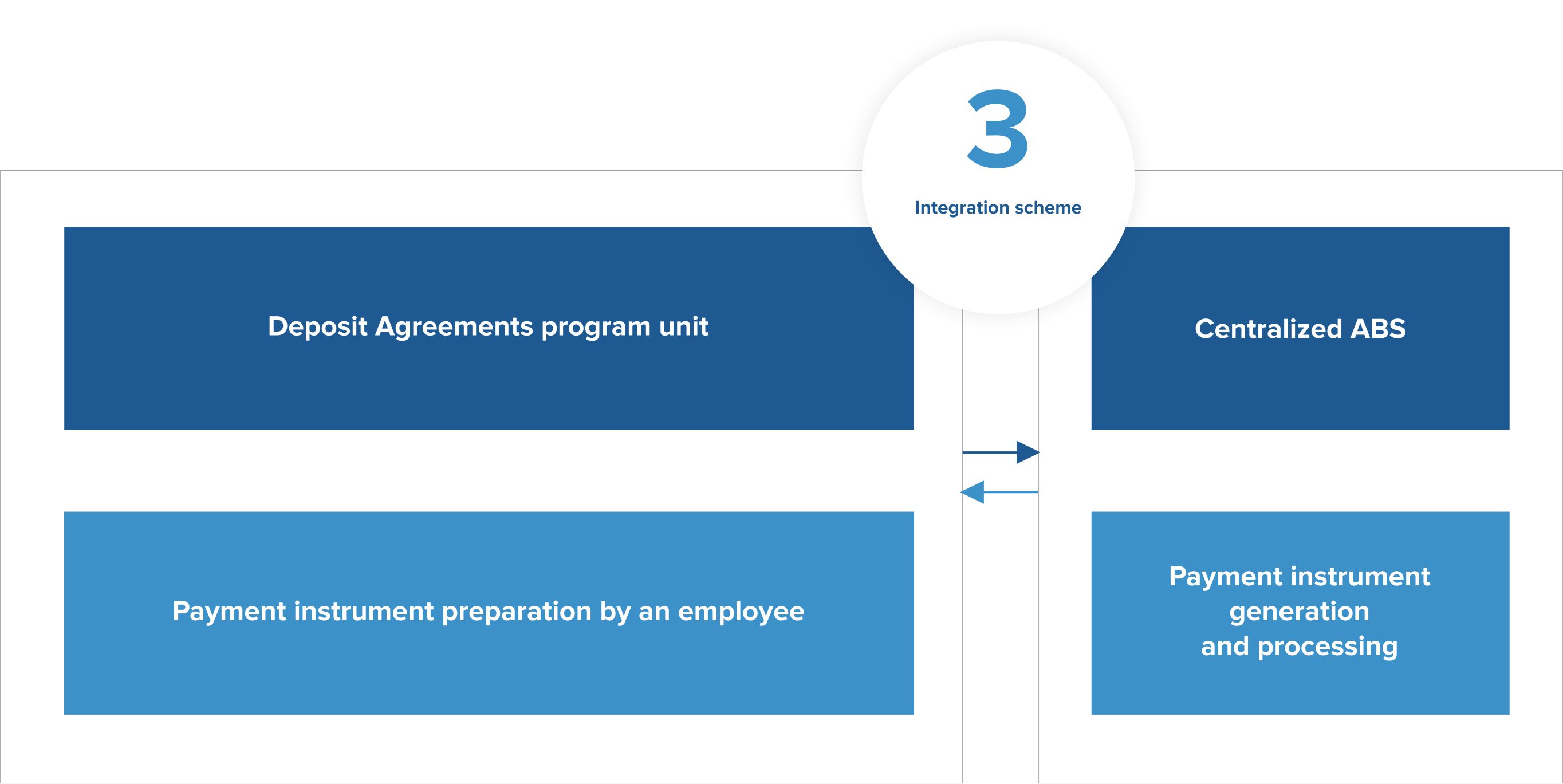

- Payment instrument preparation;

- Monitoring and linking of documents generated in the “Centralized ABS” to transactions;

- Preparation and printing of contract texts by a template;

- Transaction rollback and taking of declared actions;

- A contract prolongation with modification of its conditions.

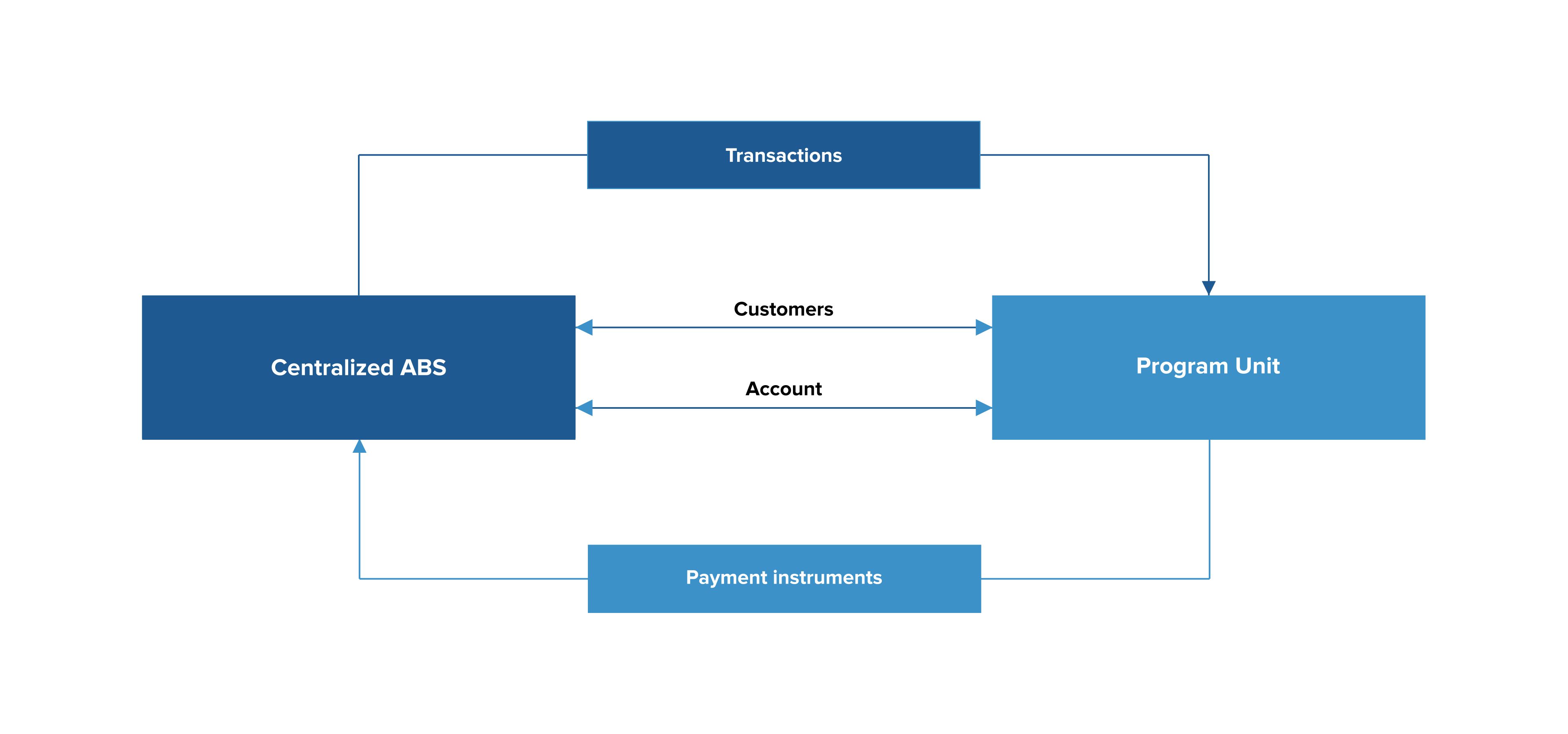

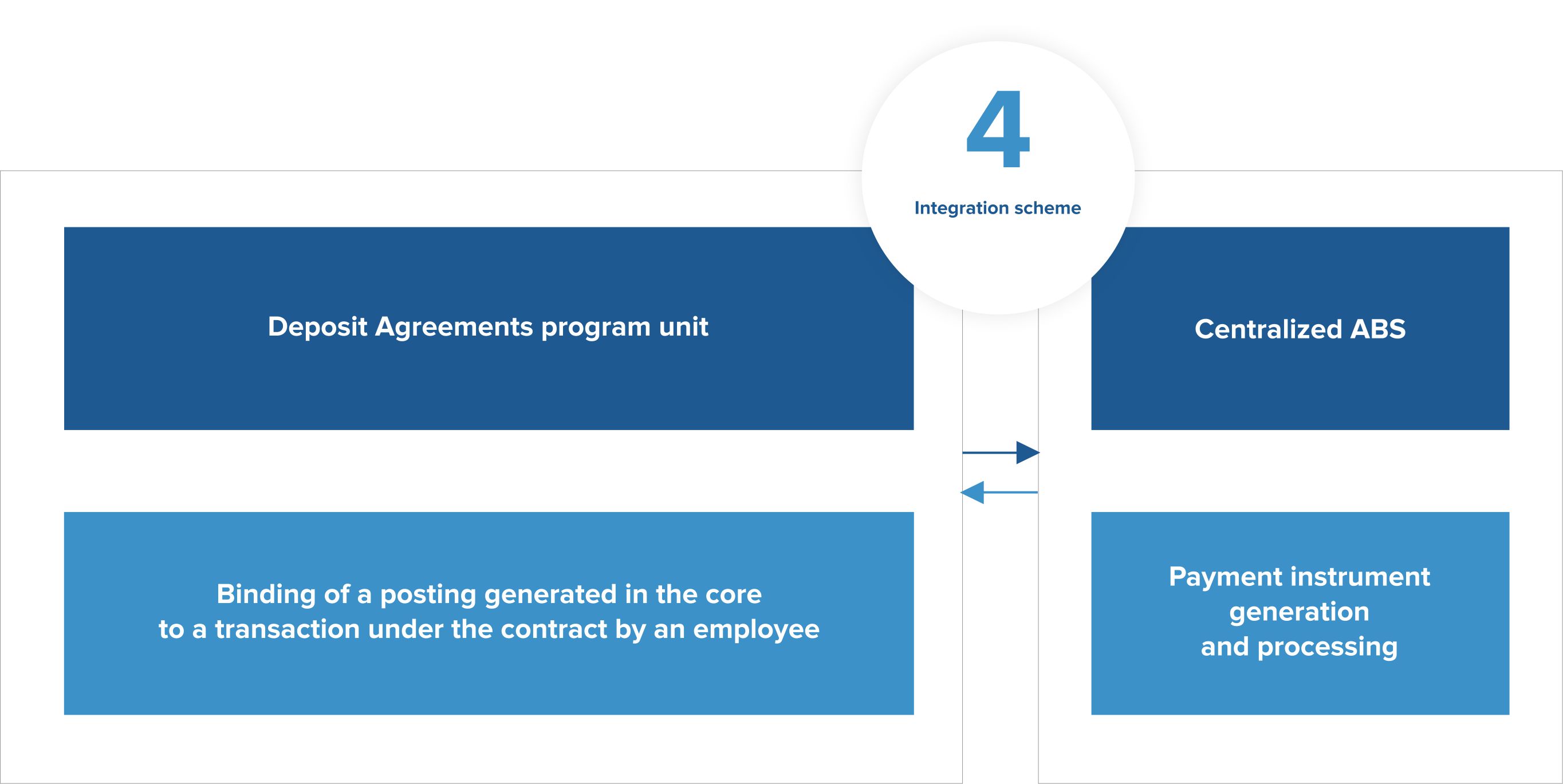

Program unit integration with the “Centralized ABS”:

The program unit uses a customer base and a number of “Centralized ABS” accounts. Moreover, accounts can be opened both in the “Centralized ABS” and directly in the program unit. Depending on a type of a transaction, payment instruments can be generated in the program unit, instruments are further processed in the “Centralized ABS” in a standard manner based on a payment instrument type, while all restrictions imposed on an instruments type and accounts specified therein (processing technology, negative balance check, status, etc.) are under control. It is possible to link the transaction generated in the “Centralized ABS” to the transaction under the contract.

Sustained Reporting:

- Standard reporting of the National (Central) Banks (depends on the country);

- A set of internal analytical reports;

- Option to self-report;

- Report implementation on the bank’s request;

- Report unloading in different formats (Excel, Word, Dbf, etc.).

Accounting (Depends on the Country).

By using our subsystem, you will be able:

- To generate accounting documents for the purposes of record keeping on accounts within the framework of the “Operation Bank Day” complex;

- To identify (compare) postings of “internal” accounts with postings generated within the framework of the “Operation Bank Day” complex;

- If necessary, to independently change the accounting model, on the basis of which the subsystem generates accounting documents.

MS OFFICE integration:

- Automatic completion of individual contracts using MS WORD;

- Printing a wide range of reports using MS WORD, MS EXCEL;

- Custom reports configuring.

The information system allows you to transfer, process and summarize all primary data quickly. Interface with other program units:

- Receiving information on incoming payment instruments from “the Accounting program unit” (depends on the country).

- Deposits use standard functions of “the Accounting program unit”, “ABS” (automated banking system):

- Generation of outgoing, internal, cash payment instruments (for further processing in “the Accounting program unit”);

- Adding information to external directories (“Client Catalogue”, “Personal Account Catalogue”).

Audit and security:

- Users’ action fixation (audit);

- Correction of errors made by the operator through a system of recovery;

- A flexible system for organizing user access rights to the functionality of the subsystem.

The information system provides a clear regulation of operator rights and his actions monitoring.

Access rights.

The system of organization of user rights is multilevel:

- Level 1 : Access to information;

- Level 2 : Access to menu items;

- Level 3 : Access to configuration functionality.

Main advantages:

- Option to record the full cycle of actions on deposits;

- Automatic generation of accounting documents;

- Option to receive full packages of documents and reports;

- Easy navigation and user-friendly interface.